First of all, I wish all of you a HAPPY CHINESE NEW YEAR and may the year of the Rooster be a better year for you! Let's HUAT together in this value investing knighthood!

Today the focus will be on one of the largest players in interior design (ID) and luxury furniture supplier in Singapore, Nobel Design Holdings Ltd (SGX:547). Nobel Design (ND) also has business operations in furniture supply chain distribution and property development. The supply chain distribution is operated by ND's 73.15% owned subsidiary, Buylateral Group which provides contemporary and classical furniture as well as home accessories from Asia to the major retailers in the United States (USA). In the property development front, ND has partnered Joint Ventures (JV) to tap on the expertise of its JV partners to develop mainly residential properties in Singapore although they have their first investment foray into hotels and retail property (i.e. Macpherson Mall: to be TOP in Dec 2018). Other than Singapore, they have also invested in their first London property - 163 unit turnkey apartment project at Marine Wharf East in May 2014. Now, let's explore the factors that make this a princess you may consider rescuing.

1. Cash Is King

As at 30 Sep 2016, ND is in a net cash position of SG$115.6m, 33% more than its total market capitalisation. The Net Current Asset Value, NCAV (Current Assets - Total Liabilities) is SG$119.9m, 37% more than the total market capitalisation. Such a high cash balance implies that if you buy ND today (i.e. 31 Jan 2017) at SG$0.41 and if the company enters into a liquidation the next day, you are still entitled to receive SG$0.56 per share after the company pays off its liabilities, assuming the company can easily liquidate its current assets. This approximates 37% returns based on today's share price.Ernst & Young (EY), the auditors of ND appointed since Sep 2015, has issued a qualified audit report for FY2015 as they were not able to ascertain the inventory amounts at the start of FY2015. Below is a screenshot on their basis for the qualified audit report.

Even if all other assets including inventories are not considered in the liquidation example, the company will still be able to repay all liabilities using its latest cash balances and result in a NCAV of SG$0.39 per share. That is only 6% below the current share price. Below is the summary of the numbers I have mentioned above.

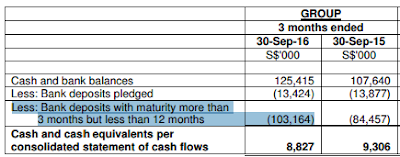

The next important consideration is whether these cash balances are existent. As disclosed in Q3 2016 financials, the company is placing most of their cash (SG$103.1m) in fixed deposits with maturity more than 3 months but not longer than 12 months. As they are bank deposits, the auditors can ascertain existence easily by sending bank confirmations, hence these cash balances are unlikely to be placed in bogus accounts.

2. Negative Enterprise Value

ND has a negative Enterprise Value (Total Market Capitalisation + Total Preferred Shares + Total Market Debt + Non-Controlling Interests - Total Cash and Cash Equivalents) of minus SG$23.5m due to the high cash balances. What does this imply? If a company acquires ND, not only does it not need to pay any cash, it will still be able to pocket SG$23.5m. Where can we find such a good lobang?? Such companies are very rare in today's context.Therefore, ND may be a potential acquisition target for companies wanting to achieve a foothold in Singapore's ID and furniture business or USA's furniture supply chain distribution. However, we have to be careful as there may be off-balance sheet debt such as committed operating leases of SG$21.3m (this will be lower in present value terms) over the next 5 years. Refer to the note below as extracted from the Annual Report 2015.

We also have to consider contingent liabilities such as corporate guarantees of SG$109.5m given to banks in relation to credit facilities of JV which may be potentially claimed against the company in the future. At this point, ND claimed that the JVs are in net assets position and are profitable so the probability of contractual outflows may be remote. Refer to the note below as extracted from the Annual Report 2015.

3. Insider buying

Besides the high valuation, there were insider buying activities in the past 3 months which is also another consideration point to wield our swords of value. The exercise price of the last tranche of Employee Share Options (ESOs) is SG$0.40. Hence, this indicates insiders' optimism on NB's outlook as ESOs were exercised near to the current share price.

The CEO, Terence Goon has bought 409,000 shares at SG$0.40 per share on 18 Jan 2017. The table below summarizes other insider buying activities, with total recent investment amounting to SG$2.3m and weighted average share price transacted at SG$0.357.

If ND has such a rich valuation as compared to its share price, why hasn't its share price corrected? Here are my two cents.

Corporate Governance Issues

The FY2014 financial statements were revised mainly due to the inappropriate application of new accounting standards, FRS111 on how the Joint Ventures' (JV) financials were presented. Before the revised FS, ND used proportionate consolidation (i.e. line by line item consolidation) which implies that the assets and liabilities would be higher. After the revision, the JVs are accounted using the equity method and only 1 line item each will be presented in the Profit and Loss (i.e. Share of profits from JV) and the Balance Sheet (i.e. Investment in JV). The shareholders were not impressed with the competence of the Audit Committee.

The former Chairman and founding member of ND, Mr Bert Choong was ousted out of the Board room in Mar 2013 as the CEO and other directors had alleged that Mr Choong conducted himself in a manner prejudicial to the interests of the group and in breach of his fiduciary duties. In return, Mr Choong sued the CEO and 3 other directors for defamation to prove his innocence. Fortunately, this boardroom tussle and lawsuit has come to an end after the concerned parties have decided to settle amicably outside the courts.

ND has also changed auditors to EY from Nexia TS after a short span of less than 4 years. This may imply that the accounting process may not be that robust and accounting personnel may not be competent enough. In fact, I have spotted a few minor inconsistencies in the latest annual report myself.

Hence, ND has a mountain to cross to gain back the trust of the shareholders and market in order for its value to be uncovered.

Negative Business Outlook

Due to lower luxury property sales in recent years, the ID and furniture sales were greatly affected. Besides, more families are buying furniture from overseas or through e-commerce. This is an industry disruption to the furniture suppliers and ND was not spared from the slowing market. As at 31 Dec 2015, contribution from the ID and furniture sales segment made up about 60% of the total adjusted EBITDA (Earnings before interests, taxes, depreciation and amortisations, share of profits from associates and JV). The adjusted EBITDA from ID and furniture sales have been reducing over the years and the 5-Year Compounded Annual Growth Rate (CAGR) is -11.4%. Therefore, the management has to seek new business opportunities in property development or furniture supply chain distribution.

Capital Misallocation

Over the recent years, ND has not been very generous with their dividends as shown in the table below. Shareholders or potential investors may be discouraged by the fact that ND has been hoarding its cash and cash equivalents for the past few financial years and excess cash is sitting in fixed deposits which probably generates less than 2% interest. This does not optimize cash returns and if there are no value-accretive projects in sight which can meet the company's WACC (weighted average cost of capital), the management and board should consider to increase the dividends so shareholders can plough the cash into investments that can generate higher returns. We may need an activist investor to urge the management to return the excess cash to shareholders, just like what happened to Metro Singapore.

In conclusion, Nobel Design is a company with value to be unlocked from the high net cash position but the company has some room for improvement in its corporate governance and capital allocation. Will this be a princess you are willing to rescue? You probably have to make a decision by weighing the pros and cons discussed above. Please also note that this company is much more illiquid than Chuan Hup so beware of a potential value trap. (Stock price remains low or can go even lower although there is value to be unlocked)Please feel free to post any comments and questions you have or subscribe to the VALUE INVESTING KNIGHT if you think the post is worth your time.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation in return. I have no business relationship with any company whose stock is mentioned in this article.

THE V.I.K

Today the focus will be on one of the largest players in interior design (ID) and luxury furniture supplier in Singapore, Nobel Design Holdings Ltd (SGX:547). Nobel Design (ND) also has business operations in furniture supply chain distribution and property development. The supply chain distribution is operated by ND's 73.15% owned subsidiary, Buylateral Group which provides contemporary and classical furniture as well as home accessories from Asia to the major retailers in the United States (USA). In the property development front, ND has partnered Joint Ventures (JV) to tap on the expertise of its JV partners to develop mainly residential properties in Singapore although they have their first investment foray into hotels and retail property (i.e. Macpherson Mall: to be TOP in Dec 2018). Other than Singapore, they have also invested in their first London property - 163 unit turnkey apartment project at Marine Wharf East in May 2014. Now, let's explore the factors that make this a princess you may consider rescuing.

1. Cash Is King

As at 30 Sep 2016, ND is in a net cash position of SG$115.6m, 33% more than its total market capitalisation. The Net Current Asset Value, NCAV (Current Assets - Total Liabilities) is SG$119.9m, 37% more than the total market capitalisation. Such a high cash balance implies that if you buy ND today (i.e. 31 Jan 2017) at SG$0.41 and if the company enters into a liquidation the next day, you are still entitled to receive SG$0.56 per share after the company pays off its liabilities, assuming the company can easily liquidate its current assets. This approximates 37% returns based on today's share price.Ernst & Young (EY), the auditors of ND appointed since Sep 2015, has issued a qualified audit report for FY2015 as they were not able to ascertain the inventory amounts at the start of FY2015. Below is a screenshot on their basis for the qualified audit report.

Even if all other assets including inventories are not considered in the liquidation example, the company will still be able to repay all liabilities using its latest cash balances and result in a NCAV of SG$0.39 per share. That is only 6% below the current share price. Below is the summary of the numbers I have mentioned above.

The next important consideration is whether these cash balances are existent. As disclosed in Q3 2016 financials, the company is placing most of their cash (SG$103.1m) in fixed deposits with maturity more than 3 months but not longer than 12 months. As they are bank deposits, the auditors can ascertain existence easily by sending bank confirmations, hence these cash balances are unlikely to be placed in bogus accounts.

|

| As disclosed in 30 Sep 2016 Financials |

ND has a negative Enterprise Value (Total Market Capitalisation + Total Preferred Shares + Total Market Debt + Non-Controlling Interests - Total Cash and Cash Equivalents) of minus SG$23.5m due to the high cash balances. What does this imply? If a company acquires ND, not only does it not need to pay any cash, it will still be able to pocket SG$23.5m. Where can we find such a good lobang?? Such companies are very rare in today's context.Therefore, ND may be a potential acquisition target for companies wanting to achieve a foothold in Singapore's ID and furniture business or USA's furniture supply chain distribution. However, we have to be careful as there may be off-balance sheet debt such as committed operating leases of SG$21.3m (this will be lower in present value terms) over the next 5 years. Refer to the note below as extracted from the Annual Report 2015.

We also have to consider contingent liabilities such as corporate guarantees of SG$109.5m given to banks in relation to credit facilities of JV which may be potentially claimed against the company in the future. At this point, ND claimed that the JVs are in net assets position and are profitable so the probability of contractual outflows may be remote. Refer to the note below as extracted from the Annual Report 2015.

3. Insider buying

Besides the high valuation, there were insider buying activities in the past 3 months which is also another consideration point to wield our swords of value. The exercise price of the last tranche of Employee Share Options (ESOs) is SG$0.40. Hence, this indicates insiders' optimism on NB's outlook as ESOs were exercised near to the current share price.

The CEO, Terence Goon has bought 409,000 shares at SG$0.40 per share on 18 Jan 2017. The table below summarizes other insider buying activities, with total recent investment amounting to SG$2.3m and weighted average share price transacted at SG$0.357.

If ND has such a rich valuation as compared to its share price, why hasn't its share price corrected? Here are my two cents.

Corporate Governance Issues

The FY2014 financial statements were revised mainly due to the inappropriate application of new accounting standards, FRS111 on how the Joint Ventures' (JV) financials were presented. Before the revised FS, ND used proportionate consolidation (i.e. line by line item consolidation) which implies that the assets and liabilities would be higher. After the revision, the JVs are accounted using the equity method and only 1 line item each will be presented in the Profit and Loss (i.e. Share of profits from JV) and the Balance Sheet (i.e. Investment in JV). The shareholders were not impressed with the competence of the Audit Committee.

The former Chairman and founding member of ND, Mr Bert Choong was ousted out of the Board room in Mar 2013 as the CEO and other directors had alleged that Mr Choong conducted himself in a manner prejudicial to the interests of the group and in breach of his fiduciary duties. In return, Mr Choong sued the CEO and 3 other directors for defamation to prove his innocence. Fortunately, this boardroom tussle and lawsuit has come to an end after the concerned parties have decided to settle amicably outside the courts.

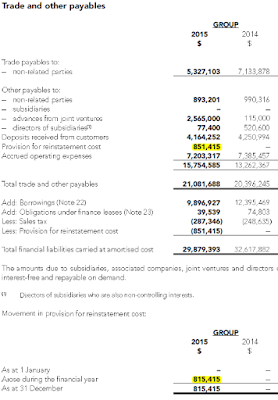

ND has also changed auditors to EY from Nexia TS after a short span of less than 4 years. This may imply that the accounting process may not be that robust and accounting personnel may not be competent enough. In fact, I have spotted a few minor inconsistencies in the latest annual report myself.

|

| Provision for reinstatement costs seems to be inconsistent. Just trying to prove my point but it is a minor error |

Negative Business Outlook

Due to lower luxury property sales in recent years, the ID and furniture sales were greatly affected. Besides, more families are buying furniture from overseas or through e-commerce. This is an industry disruption to the furniture suppliers and ND was not spared from the slowing market. As at 31 Dec 2015, contribution from the ID and furniture sales segment made up about 60% of the total adjusted EBITDA (Earnings before interests, taxes, depreciation and amortisations, share of profits from associates and JV). The adjusted EBITDA from ID and furniture sales have been reducing over the years and the 5-Year Compounded Annual Growth Rate (CAGR) is -11.4%. Therefore, the management has to seek new business opportunities in property development or furniture supply chain distribution.

|

| As extracted from the segment information note in the Annual Reports from the past 5 years |

Over the recent years, ND has not been very generous with their dividends as shown in the table below. Shareholders or potential investors may be discouraged by the fact that ND has been hoarding its cash and cash equivalents for the past few financial years and excess cash is sitting in fixed deposits which probably generates less than 2% interest. This does not optimize cash returns and if there are no value-accretive projects in sight which can meet the company's WACC (weighted average cost of capital), the management and board should consider to increase the dividends so shareholders can plough the cash into investments that can generate higher returns. We may need an activist investor to urge the management to return the excess cash to shareholders, just like what happened to Metro Singapore.

|

| As extracted from Annual Reports and SGX Cafe |

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation in return. I have no business relationship with any company whose stock is mentioned in this article.

THE V.I.K

No comments:

Post a Comment